Consulting Services

Expert risk management solutions built on 20+ years of financial services experience

Risk Advisory Expertise

With over two decades of experience in financial services risk management, our approach centres on the development of robust, adaptable risk and control frameworks designed to support operational resilience, align with business objectives, and enhance clarity in decision-making.

Our approach combines analytical rigour with practical implementation to help organisations navigate complex risk landscapes effectively. Core areas of expertise include enterprise risk, control frameworks, regulatory reporting, and scenario-based risk analysis.

Risk Management Consultant

UK-based, open to remote engagements worldwide

Consulting Services

Expert leadership in scenario development, stress testing, and wind-down planning. Enabling organisations to take a proactive approach to risk identification and mitigation through data-driven methodology.

Comprehensive guidance on regulatory processes including ORSA, ICARA, and compliance requirements. Strategic alignment of risk management frameworks with business objectives and regulatory expectations.

Design and implementation of customised risk and control frameworks that enhance operational resilience while supporting business growth. Practical approaches that embed risk management into daily operations.

Tailored training programs and mentoring in risk management methodologies. Building internal capabilities and fostering a positive risk culture across all levels of the organisation.

Risk Insights Explorer

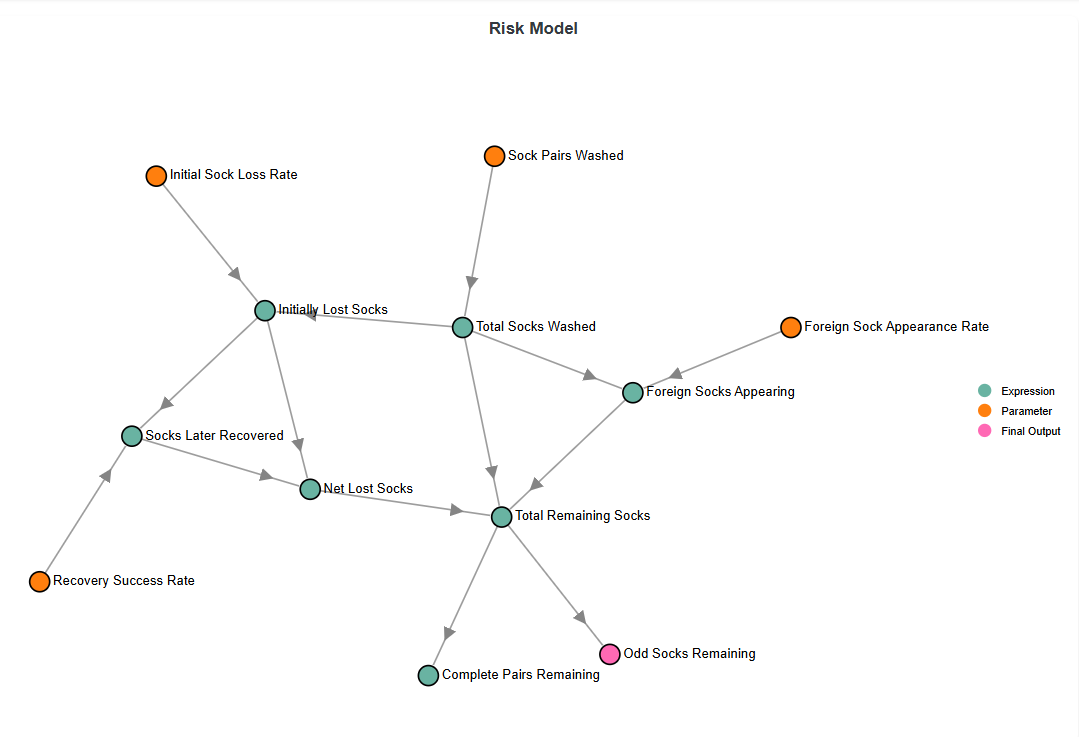

Risk Insights Explorer is an intuitive, scenario-based tool that transforms operational risk assessment, bringing unprecedented clarity and structure to complex risk scenarios.

The platform structures everything—from parameters (things that can change) to assessments (ways those parameters might vary) to expressions (calculations that show the final impact)—creating a transparent audit trail for all stakeholders.

This innovative tool makes advanced risk modelling accessible even to those new to Monte Carlo methods, empowering organisations to develop structured insights for effective risk governance.

Key Strengths

Skilled in creating data-driven risk models and visualisation tools to inform decision-making at all levels. Transforming complex risk data into clear, actionable insights for senior management and boards.

Extensive experience in designing frameworks that align risk management with business goals and regulatory requirements. Creating structures that provide clarity and confidence in decision-making.

Proven ability to translate complex risk insights into clear, actionable guidance for senior management and boards. Building trust and confidence in risk assessment processes across the organisation.

Balancing theoretical best practices with practical implementation realities. Developing solutions that work in the real world, with real constraints and diverse stakeholder needs.

Client Perspectives

"The scenario-based approach transformed how our board understands operational risk. For the first time, we have complete clarity on how different risk factors contribute to our overall exposure."

— Chief Risk Officer, Financial Services Firm

"The framework implemented was both comprehensive and practical—exactly what we needed to satisfy regulatory requirements while supporting our business objectives. The training provided ensured our team could maintain and evolve the framework independently."

— Head of Operational Risk, Asset Management

Ready to Transform Your Risk Management?

Let's discuss how my expertise and approach can help your organisation navigate complexity with confidence, meet regulatory requirements with ease, and enhance decision-making with clear risk insights.