Modernising Emerging Risk Practices

Helping a UK insurance consortium develop a more robust and forward-looking approach to emerging risk

Client Context

Our client, a consortium of UK insurers formed to address common industry challenges, recognised that their existing approaches to emerging risk identification and assessment were becoming increasingly inadequate in a rapidly evolving risk landscape. The consortium sought external expertise to help modernise their collective approach to emerging risks.

Initial Limitations

- Traditional approach that struggled to capture complex risk characteristics

- Reactive rather than proactive risk identification methods

- Limited ability to translate emerging risk insights into strategic planning

- Inconsistent risk identification methods across member organisations

- Difficulty prioritising resources for emerging risk management

Our Approach

We introduced structured horizon scanning methodologies to help identify emerging risks earlier and more systematically, moving beyond news monitoring to proactive trend analysis and weak signal detection.

We implemented risk categorisation and mapping to visualise and analyse the relationships between members' emerging risks, helping categorise associated risks and promote proactive management across the insurance sector.

We developed a structured approach for characterising different types of uncertainty in emerging risks, moving beyond probability and impact to more relevant characteristics appropriate for emerging risks.

We facilitated cross-company collaboration through structured workshops and shared frameworks, allowing consortium members to leverage collective intelligence while retaining competitive independence.

Implementation Journey

Our engagement with the consortium was structured as a transformation program over 12 months, designed to build capability while delivering immediate value.

- Diagnostic Assessment: We conducted a detailed review of existing emerging risk processes across member organisations, identifying common challenges and capability gaps.

- Framework Development: We co-created a new emerging risk assessment framework that shifted focus from discrete impacts to system-level analysis.

- Capability Building: We worked with member's risk and finance teams on the methodology and supporting tools.

- Documentation: We helped develop comprehensive documentation reporting to the member clients on the methodology and analysis results.

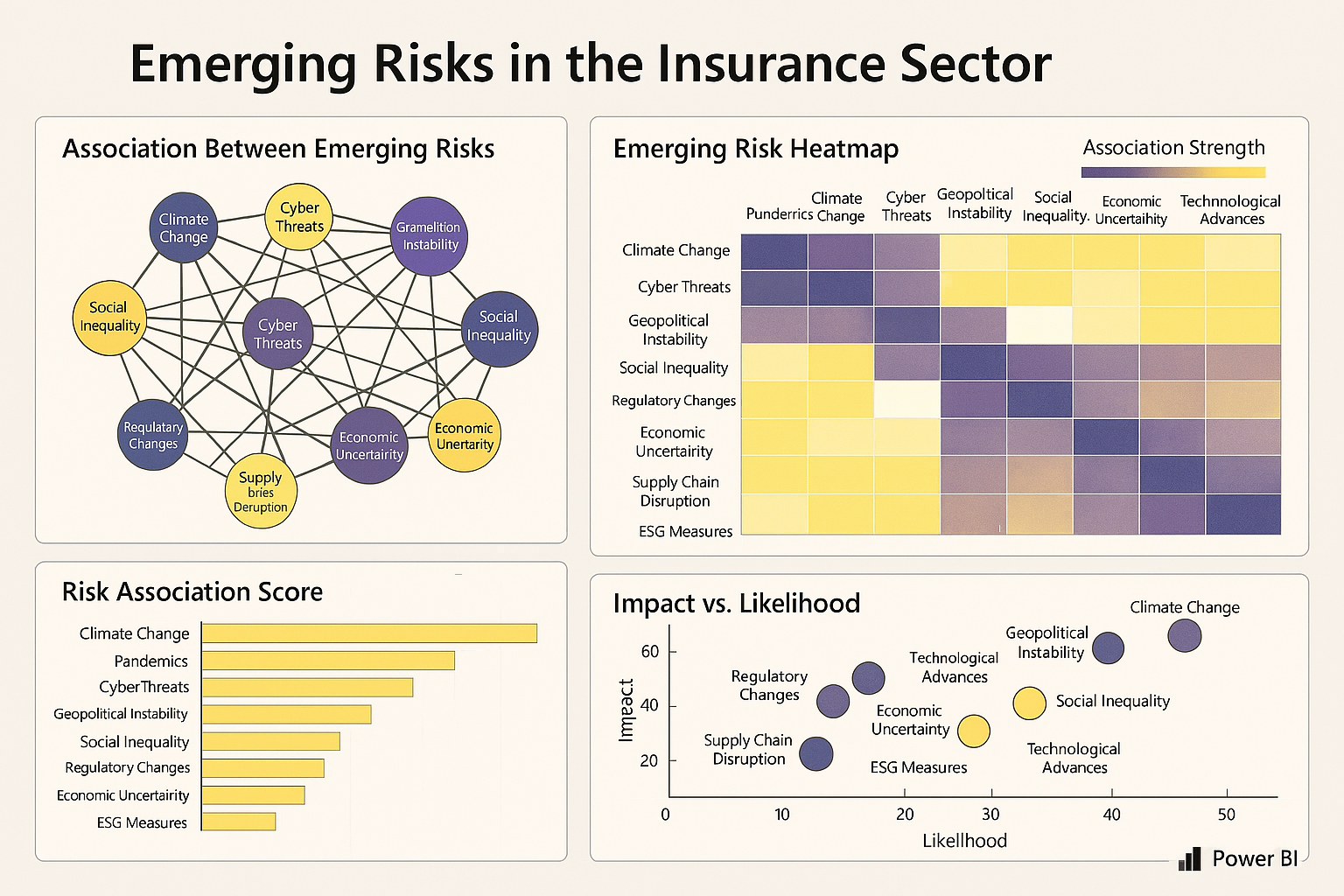

PowerBi reports detailing associations between emerging risks in the insurance sector

Key Methodological Innovations

A critical innovation in our approach was shifting away from premature quantification of impacts for emerging risks. Rather than forcing numeric estimates where fundamental uncertainty exists, we introduced a framework that:

- Characterises different types of uncertainty

We introduced conditional risk assessment methodologies that helped the consortium:

- Analyse how emerging risks might manifest differently under various market conditions

Outcomes & Value Created

The new horizon scanning process identified three significant emerging risks that had not been previously captured through traditional methods, allowing for earlier consideration in business planning.

Project Reflections

The consortium project highlighted several important lessons about advancing emerging risk practices in a collaborative context:

- Balancing standardisation and flexibility is essential - establishing common terminology and frameworks while allowing for customisation to individual company contexts.

"The consortium's approach to emerging risks had become a checkbox exercise. Risk Portal helped us transform it into a genuinely valuable process that informs strategy and builds resilience. Their willingness to challenge established practices while remaining practical was particularly valuable."

— Chair of the Emerging Risks Committee, Insurance Consortium

Transform Your Emerging Risk Approach

If your organisation is struggling with emerging risk identification and assessment, our team can help you develop more sophisticated, practical approaches that deliver genuine business value beyond compliance.